Another billionaire buyout in the gaming industry by Saudi Arabia’s investors raised concerns amongst the community. However, this could be exciting news for EA.

After a week of leaks and speculation, the acquisition of Electronic Arts (EA) by Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Jared Kushner’s Affinity Partners for approximately $55 billion has been confirmed.

Despite the magnitude of the deal, concerns are rising about EA’s future. To finance the buyout, the PIF loaned around $20 billion with one condition: taking the company private. As a result, shareholders will receive $210 per share. Before Saudi Arabia’s involvement, shares were valued at $168.32.

EA’s current CEO, Andrew Wilson, called the acquisition “one of the largest and most significant investments ever made in the entertainment industry.” In a public letter, he expressed excitement about the future, stressing that the new partners believe in the company’s vision and team. He also highlighted their global experience in gaming and entertainment.

Saudi Arabia is no stranger to major esports and gaming investments. In January 2022, the PIF acquired the ESL FACEIT Group (EFG) merger through its Savvy Games Group initiative, aimed at growing the regional gaming market for more than 420 million Arabic speakers.

“Savvy Games Group was created by PIF to drive the long-term growth of the global games and esports industry and develop Saudi Arabia into a games and esports hub,” said Brian Ward, CEO of Savvy Games Group."

Concerns raised over the EA acquisition

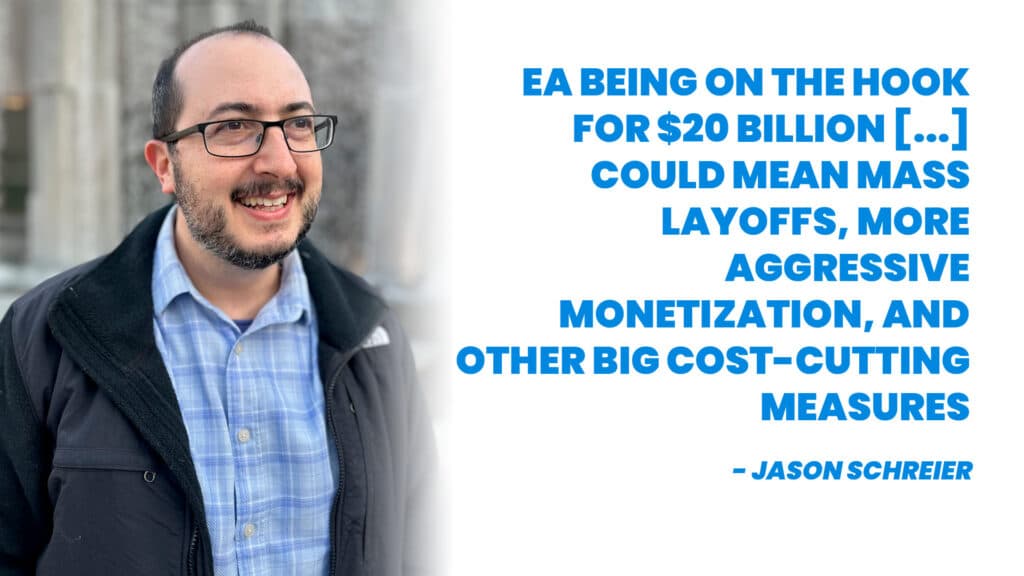

In simple terms, debt often leads to layoffs. Bloomberg reporter Jason Schreier warned that “the far bigger immediate impact will come from the new private EA being on the hook for $20 billion in debt. That could mean mass layoffs, more aggressive monetization, and other big cost-cutting measures.”

A paywalled Financial Times report also noted that the investor group is betting heavily on artificial intelligence to cut operational costs. “The investors are betting that AI-based cost cuts will significantly boost EA’s profits in coming years” the report stated, reinforcing Schreier’s warnings of cost-cutting measures.

EA’s new owners are now in control of major gaming titles

Alongside previous investments like EFG, the EA acquisition hands PIF, Silver Lake, and Affinity Partners control over some of the biggest franchises in gaming, including:

- EA SPORTS (FC, NFL, Madden, College Football, etc.)

- The Sims

- Battlefield

- Need for Speed

- Apex Legends

- Plants vs. Zombies

Earlier this year, the PIF also acquired Niantic Inc. (Pokémon Go) for $3.5 billion and Scopely Inc. (Monopoly Go) for $4.9 billion.

While EA’s press release emphasized trust in its teams and leaders, the company’s future remains uncertain. Whether layoffs or AI-driven cost cuts become reality is still speculation, but the industry is watching closely.

For updates on this story, stick around on esports.gg.